the essential insurance needed by the property preservation contractor

INTRODUCTION

Across the country, networks are putting resources into property preservation data processing company to defend significant local area resources and ensure the benefit of encompassing homes and neighbourhoods. As a property preservation contractor, you’ll need to exploit the local area interest by ensuring that you’re ready to go beforehand, so when your services are required, you can be first in the place.

Property preservation expects you to have a few unique kinds of insurance, usually, before you start work or within 30 days of the beginning date. Ensuring you have all the fundamental inclusion already can assist you with securing your business and staying ahead of your adversaries.

While some protection necessities may fluctuate by state, here are the most primary sorts of insurance coverage:

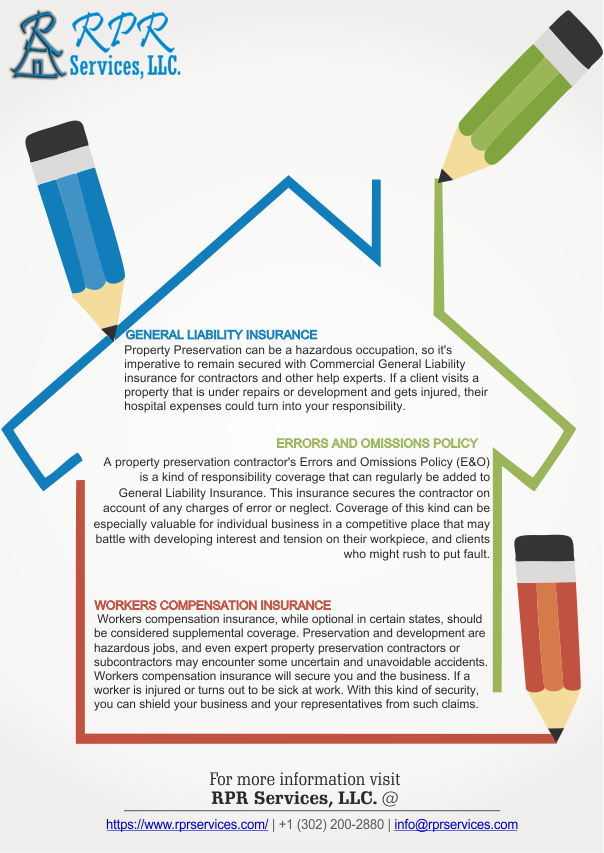

General Liability Insurance: Property Preservation can be a hazardous occupation, so it’s imperative to remain secured with Commercial General Liability insurance for contractors and other help experts. If a client visits a property that is under repairs or development and gets injured, their hospital expenses could turn into your responsibility. To maintain a strategic distance from these sort of issues, you have to ensure you have claim coverage for every single accidents or issue. This assurance can help your contracting business from claims, costly hospital expenses, and different accidents that are out of your control.

Errors and Omissions Policy: A property preservation contractor’s Errors and Omissions Policy (E&O) is a kind of responsibility coverage that can regularly be added to General Liability Insurance. This insurance secures the contractor on account of any charges of error or neglect. Coverage of this kind can be especially valuable for individual business in a competitive place that may battle with developing interest and tension on their work piece, and clients who might rush to put fault. This approach placed above General Liability insurance and fills in as an extra degree of assurance for your business.

Workers Compensation Insurance: Workers compensation insurance, while optional in certain states, should be considered supplemental coverage. Preservation and development are hazardous jobs, and even expert property preservation contractors or subcontractors may encounter some uncertain and unavoidable accidents. Workers compensation insurance will secure you and the business. If a worker is injured or turns out to be sick at work. With this kind of security, you can shield your business and your representatives from such claims.

RPR Service is a property preservation work order processing and updating company, who provide all types of data processing for REO servicers and inspections QC and processing services to National, Regional, and Inspection Companies.

Don’t just take it from us

Let our clients do the taking

WHAT OUR CLIENTS SAY

Verified Reviews From Clutch.co

Send us a Message

Other posts

How to successfully hire vendors for a property preservation company?

hire vendors for a property preservation company introductionProfessional vendors offer comprehensive property preservation services for...

What is the difference between REO & Foreclosed property?

the difference between REo & foreclosure property introductionREO is a real estate owned property. The term REO vaguely portrays a particular...

How to find roof leak in property preservation business?

find roof leak in property preservation business introductionA roof leak in any property can make even the most desirable properties unsellable....