ReAL ESTATE OWNED

You experience the calmness and relaxation of the nature when your surrounding is covered with the mindful of thoughts and scenery.

REAL ESTATE OWNED

Introduction

REO or Real Estate Owned is a term used in the United States to portray a class of property claimed by a moneylender like a bank, government department, or government loan insurer after an ineffective deal at a foreclosure auction. Bank REO properties are usually in a feeble condition and need repairs and maintenance, both to fulfil property upkeep laws and to protect and set the property available for sale. Preservation is generally the responsibility of the mortgage service provider and is frequently thus provided by a specific property preservation company. These property preservation companies include property securing, debris removal, property maintenance (winterizing, lawn maintenance, repairing, or tarping rooftop holes), and rehabilitation.

What is an REO Property?

A Real Estate Owned property is a home that has experienced the abandonment procedure, which deferred to locate a buyer during the auction and is claimed by the bank. Banks don’t aggregate enormous amounts of money by seizing non-performing properties, however they anticipate by loaning cash to borrowers and accumulating interest. Banks aren’t in the business of holding loans that do not generate any profits. Therefore, they are more than ready to go separate ways with the properties they have repossessed. Sometimes banks are willing to sell their REO property at a discount than to hold it and retain the loss in the capital. Thus, investors end up with a decent, if not an incredible bargain.

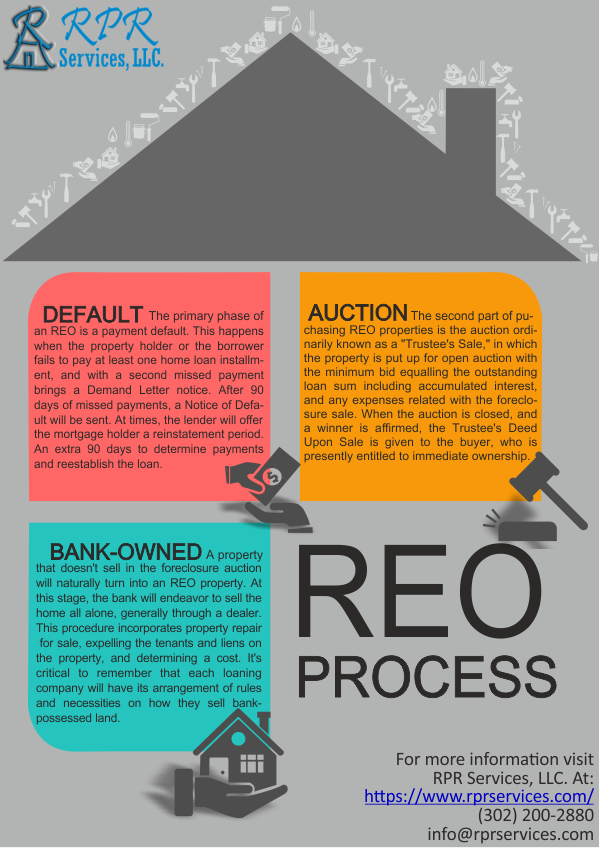

REO Process

Buying REO properties isn’t as scary as it appears. In their most sincere structure, an REO property is a foreclosed home that is presently possessed by the loan lender. The property was once customer-owned, but because of defaulting on the loan is now claimed by the bank. These properties usually experience foreclosure auction procedure to recuperate the sum owed on them, with unsold homes authoritatively turning out to be bank-possessed properties. The REO process includes three parts:

Default: The primary phase of an REO is a payment default. This happens when the property holder or the borrower fails to pay at least one home loan instalment, and with a second missed payment brings a Demand Letter notice. After 90 days of missed payments, a Notice of Default will be sent. At times, the lender will offer the mortgage holder a reinstatement period. An extra 90 days to determine payments and re-establish the loan.

Auction: The second part of purchasing REO properties is the auction ordinarily known as a “Trustee’s Sale,” in which the property is put up for open auction with the minimum bid equalling the outstanding loan sum including accumulated interest, and any expenses related with the foreclosure sale. When the auction is closed, and a winner is affirmed, the Trustee’s Deed Upon Sale is given to the buyer, who is presently entitled to immediate ownership.

Bank-owned: A property that doesn’t sell in the foreclosure auction will naturally turn into an REO property. At this stage, the bank will endeavour to sell the home all alone, generally through a dealer. This procedure incorporates property repair for sale, expelling the tenants and liens on the property, and determining a cost. It’s critical to remember that each loaning company will have its arrangement of rules and necessities on how they sell bank-possessed land.

Steps for Buying REO Properties:

Property search: Before you start the buying procedure, look for REO properties within your ideal price range and targeted market. You can find REO properties through bank or loan lender listings, MLS, a real estate agent, or online agencies like Zillow.

Finding a lender and finalizing finance: After you’ve chosen your property, find a bank, and talk with them about your financing choices. Lenders need to get an REO property off their books rapidly, so the more you are set with financing choices, the quicker it will go. Getting pre-qualified by the lender that possesses the place can accelerate this procedure too. Once they realize that you are monetarily qualified, they are bound to acknowledge your offer.

Finding a real estate buyer’s agent: One of the most significant support you can have while buying an REO property is a buyer’s agent with an REO experience. They can guide you in each step of the home purchasing process. They can likewise tell you of some other prerequisite you will need, for example, employing a lawyer or inspector for the property.

Compiling list: After you begin working with a buyer’s agent, you can narrow down a list of REO properties that fit your capabilities. Think about value, repair, area, a number of rooms and washrooms, neighborhood quality, and available resources. When you have a list of REO properties that fit your necessities, start with the most compelling property.

Make The Offer: The agent will take the proposal to the lender, and you have to file some additional paperwork. You need to give a 1-2% sincere money deposit check, which is held retained until the purchase is finalized.

Property Preservation Inspection: The home inspection process is essential in preserving yourself from obscure damages and helps in negotiating the amount. Sometimes, the inspection is already conducted once the property is owned by the bank. If so, request a copy of the report and audit it before settling on the final decision.

Negotiation: Banks will consistently attempt to get the most beneficial cost for the property being referred to. Your last offer may require a corporate endorsement. You will be asked to sign a purchase addendum, which should be thoroughly checked by you, your agent, and your lawyer.

Finalizing Loan: During finalization, you work with the bank to find the right loan for you. You also have to verify the status of the title. The bank usually clears the title before selling a property. If this is not the case, then you can do the process by yourself by hiring a title company.

Closing deal: This procedure is a lot of like settling a negotiation with a property owner. There could be charges you need to pay if you do not close the deal by the foreordained date. But you can avoid the situation by getting pre-qualified for a loan and ensuring you get the ideal sum on schedule. All that is left is for you and the lender to signing the property documents into your name.

RPR Services is a property preservation work order processing company that understands the certainty of how a foreclosed or an REO property needs to be maintained and well-kept. We provide impeccable bids with correct verbiage and the procedures to repair the damages at an REO estate which helps our clients make profits off of the preservation work from their clients.

Don’t just take it from us

Let our clients do the taking

WHAT OUR CLIENTS SAY

Verified Reviews From Clutch.co

Send us a Message

Other posts

How to make your clients satisfied in the property preservation industry?

make your clients satisfied in the property preservation industry introductionProperty preservation companies have various obligations to deal with...

Why recording the whole work is essential in the property preservation inspection process?

Why recording is essential in property preservation inspection process introductionProperty Inspectors is a vital occupation in the Property...

Why you should always have a property preservation company at your disposal?

Why to have a property preservation company at your disposal introductionNo bank wants to wind up possessing a property as you are not in the...