Deed In Lieu

Make the property more promising by protecting it from the bustle of forecloser and other issues.

Introduction to Deed in Lieu:

The Deed in Lieu (DIL) is a solution that a few purchasers select when they’re not able to make the property loan instalments. Rather than seizing the house, the loaning company acknowledges the deed and full rights to the property. The property preservation company does the other needful work for the DIL process on behalf of the company to avoid any inconvenience during the whole process. If there are any junior liens, a deed in lieu is a less alluring alternative for the moneylender. The bank probably will not have the desire to accept the risk of the lesser liens from the landowner, and the loan specialist will like to abandon to clean the title.

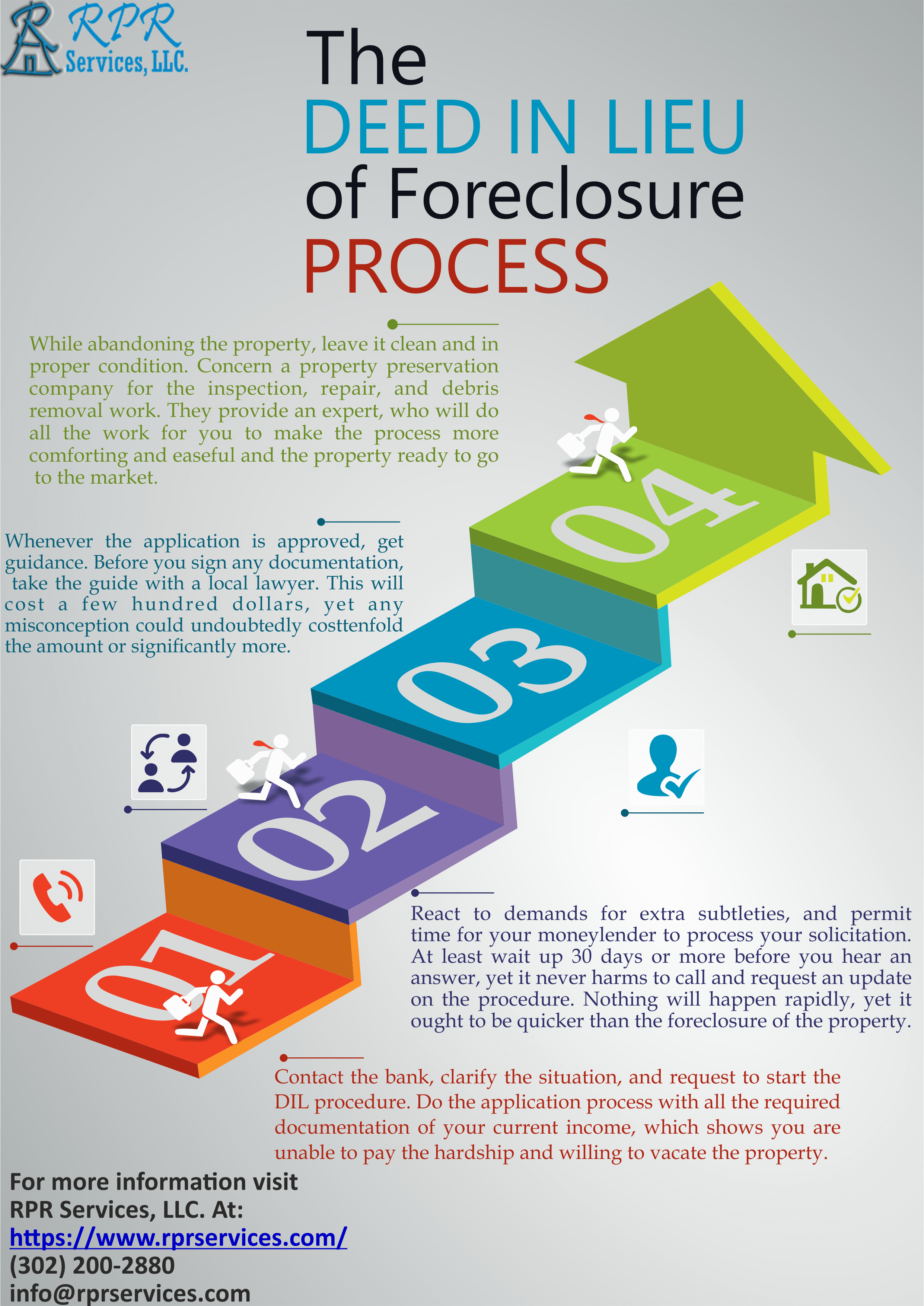

The Deed in Lieu of Foreclosure Process

- Contact the bank, clarify the situation, and request to start the DIL procedure. Do the application process with all the required documentation of your current income, which shows you are unable to pay the hardship and willing to vacate the property.

- React to demands for extra subtleties, and permit time for your moneylender to process your solicitation. At least wait up 30 days or more before you hear an answer, yet it never harms to call and request an update on the procedure. Nothing will happen rapidly, yet it ought to be quicker than the foreclosure of the property.

- Whenever the application is approved, get guidance. Before you sign any documentation, take the guide with a local lawyer. This will cost a few hundred dollars, yet any misconception could undoubtedly cost tenfold the amount or significantly more.

- While abandoning the property, leave it clean and in proper condition. Concern a property preservation company for the inspection, repair, and debris removal work. They provide an expert, who will do all the work for you to make the process more comforting and easeful and the property ready to go to the market.

Rejected Deed in Lieu of Foreclosure:

A general misunderstanding about deeds in lieu is that the property must be in foreclosure. The lender may or may not have filed a notice of default or started judicial proceedings to foreclosure but may still be open for the deed in lieu discussion. However, Banks usually avoid accepting the process under any obligation. Here are a few reasons why a bank refuses a deed in lieu:

- Profitability Issues: Such action is not profitable for the bank. If a bank believes it can make more money through foreclosure, they might reject a homeowner’s offer to deliver the deed in lieu of foreclosure.

- Property’s Worth: Usually, a property with just one credit is the best competitor. But the subsequent bank may acknowledge a deed in lieu of the main credit is present, and the property is worth more than the whole of its encumbrances.

- PSA Guidelines: PSA means to comprehend the guidelines for the process to complete, and those terms are inexorable. Numerous advances adjusted by PSAs (Pooling and Servicing Agreement) and the rules in PSAs may deny a deed in lieu of foreclosure.

- Inadequate Acknowledge: PSA may request the borrower to make a monetary commitment in return for acknowledgment of the deed in lieu, and the borrower may reject either because of the guideline or absence of the principal.

RPR Services is well aware of the in and out process of Deed In Lieu, our work order processing team help you with all you work orders in a very efficient way and provide the client in a nominal time span with highly updated and classified PCR.

Don’t just take it from us

Let our clients do the taking

WHAT OUR CLIENTS SAY

Verified Reviews From Clutch.co

Send us a Message

Other posts

Initial Secure

INITIAL SECURE It is essential to maintain the security of the place during the foreclosure period to avoid any unwanted issues to occur.INITIAL...

Roof damages

ROOF DAMAGES Roof damages are the key to many discomforts within the property repaired by the property preservation company with the help of the...

Property Condition Report(PCR)

PROPERTY CONDITION REPORT PCR is the principal element of the work order for any vendor to do the further process of property preservation work...